In the world of asset management, traditional methods often fail to capture the small, yet impactful market movements that could lead to significant returns. For Naman Jain, the CEO and founder of CredEx, this understanding became the driving force behind creating a company that blends technology and finance. With its headquarters in Dubai, CredEx uses advanced technological tools to keep its clients at the forefront of the dynamic financial world.

The Origins of CredEx

In 2025, Naman Jain, with a strong grasp of financial markets, recognized the challenges facing traditional asset management. Traders often struggled to manage the volatility of rapid market fluctuations, leading to significant losses in their portfolios. At the same time, long-term investors found that inflation and taxes eroded their returns over time. Inspired to address these issues, Jain founded CredEx—a company focused on utilizing advanced technologies to optimize asset management and ensure sustainable, long-term growth while adapting to even the smallest market movements.

CredEx’s mission is clear: to create a financial environment where technology does more than track trends—it anticipates them. This proactive approach ensures that investors can capitalize on opportunities before they become apparent to others, all while maintaining a disciplined, long-term investment strategy.

Technology at the Heart of CredEx

Unlike many traditional asset management firms, CredEx relies on a wide range of advanced technologies to make informed decisions. The company employs tools like Artificial Intelligence (AI), Machine Learning (ML), Deep Learning, and Quantum Computing to process vast amounts of data quickly and accurately. With these technologies, CredEx can analyze billions of data points every second, enabling it to predict market trends before they are visible to other investors.

One of CredEx’s key strengths is its proprietary data network, which aggregates information from a diverse range of sources. Unlike many firms that rely on a narrow set of data points, CredEx’s system scours platforms like The Wall Street Journal, Reddit, YouTube, FXCM, and Google Scholar, among others, capturing insights that traditional firms may overlook. This broad approach ensures that the company can make well-rounded, timely investment decisions that take into account the full spectrum of market activity.

By integrating AI and machine learning, CredEx’s system can continuously analyze and optimize asset allocation, ensuring investments remain strategically sound. The integration of technology with human insight enables CredEx to deliver results that would otherwise be difficult to achieve using conventional methods.

A Vision for the Future

Jain’s background in both India and the United States provides him with a unique perspective on the intersection of technology and finance. After earning a degree from the University of British Columbia and later pursuing professional credentials in entrepreneurship and innovation from Harvard Business School, Jain knew that the future of finance would be shaped by technological advancements. Returning to India, he further honed his skills before founding CredEx, with a vision to integrate emerging technologies into asset management on a global scale.

His vision for the company is focused on capitalizing on macroeconomic trends through the optimization of micro market movements, ensuring that the financial sector continues to evolve dynamically. CredEx aims to provide investors with unparalleled insights into asset management, revolutionizing how both individual investors and large institutions approach the market.

Commitment to Trust and Transparency

At the core of CredEx’s operations is a commitment to transparency and integrity. Jain emphasizes, “Investor trust is our greatest asset, and integrity is our promise.” This philosophy of ethical business practices is reflected in all aspects of the company’s operations. CredEx aims not only to grow its clients’ portfolios but also to do so in a manner that aligns with the highest standards of professionalism and transparency.

CredEx’s approach allows individual investors to monitor their portfolios in real-time, offering them peace of mind that their investments are being handled with the utmost care and precision. Whether you are an individual investor seeking steady growth or an institution looking for a reliable partner for large-scale asset management, CredEx offers solutions tailored to diverse needs.

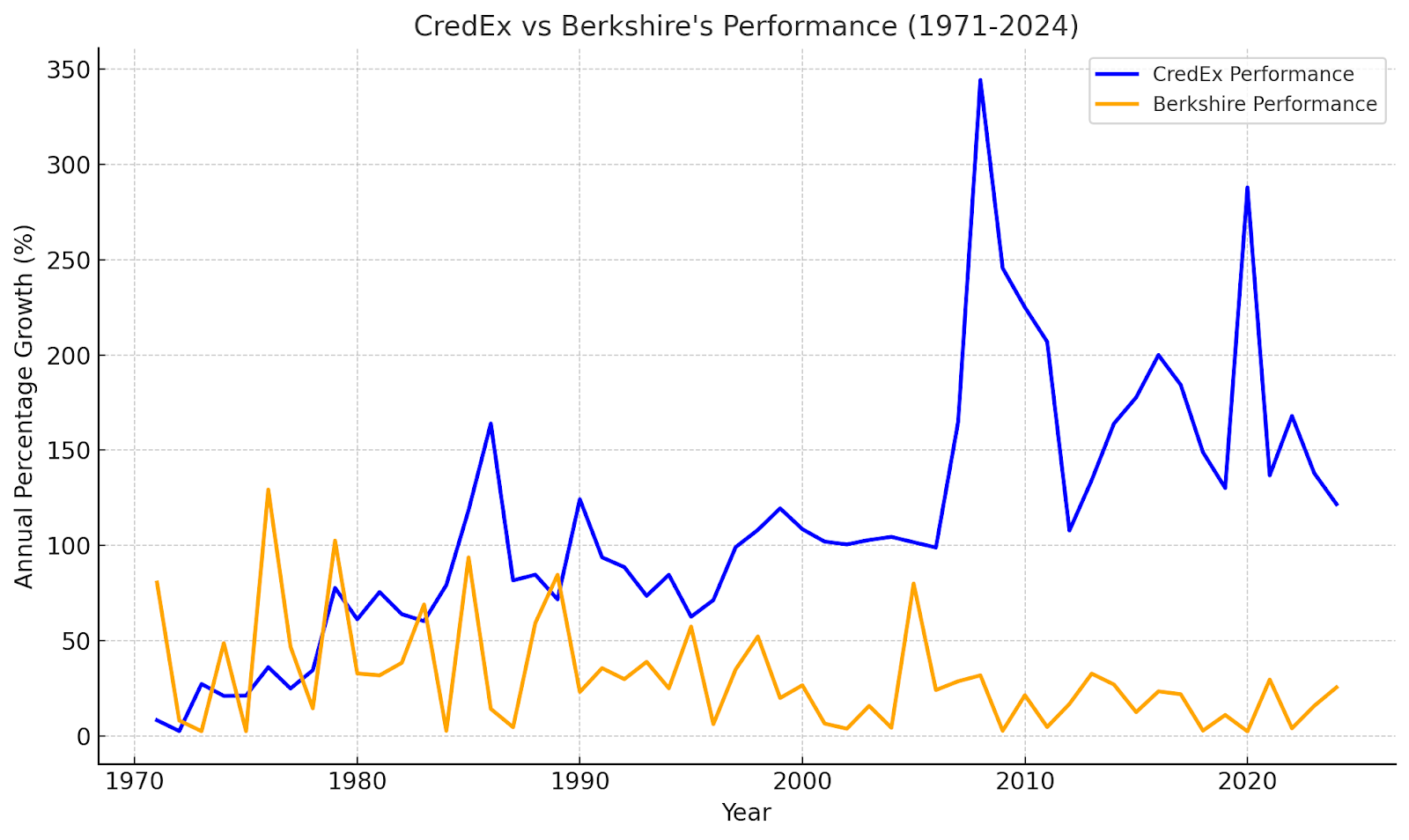

Proven Success and Forward Momentum

Although CredEx is a relatively new player in the asset management industry, its innovative use of AI and advanced analytics has already set it apart from its competitors. The company’s portfolio includes blue-chip stocks from prominent companies such as Apple, Tesla, Amazon, Meta, Microsoft, Johnson & Johnson, Bank of America, NVIDIA, Nike, Walt Disney, Pfizer, Adobe, UnitedHealth Group, VISA, ELI LILLY & CO, Verizon, Super Micro Computer, AMD, Oracle, Procter & Gamble,Palantir Technologies, and ExxonMobil, among others. They also invest in GOLD, S&P 500, UK100, WTI, DXY, Euro50, Japan225, and many others. A very little proportion of their portfolio is invested in Cryptocurrencies for portfolio diversification. By leveraging AI-driven insights, CredEx is able to position its clients for optimal growth in these leading industries.

Through its use of AI and machine learning, CredEx offers a level of precision that traditional methods cannot match. This advanced technology allows the company to make smarter, more informed decisions about asset allocation, ultimately driving long-term wealth creation for its clients.

CredEx: Leading the Way in Asset Management

As CredEx continues to push the boundaries of asset management, its use of cutting-edge technologies like Quantum Computing and Machine Learning will remain integral to its ongoing success. The company’s commitment to incorporating these technologies into its investment strategies gives it a competitive advantage in an industry that is increasingly looking toward the future.

Jain’s forward-thinking approach, combined with his deep understanding of both technology and finance, positions CredEx as an innovator in the asset management space. While many firms still rely on traditional investment methods, CredEx is paving the way toward a smarter, more efficient future for investors.

Learn More About CredEx

For those interested in exploring the future of asset management, CredEx offers valuable insights into how advanced technology can optimize investment strategies. Whether you’re looking for more information on the technologies behind their approach or the potential for long-term growth, CredEx’s platform provides the tools needed to navigate modern financial markets with confidence.

To learn more about how CredEx can help you capitalize on market trends and create financial freedom, visit their official website or follow them on Instagram and Facebook.