EcoMoat uses AI and economic moat analysis to provide accessible, objective, and unbiased investment research.

EcoMoat aims to enhance stock research by combining AI and economic moat analysis.

When Michael Shmilov, Founder & CEO of EcoMoat, launched his platform, he set out to challenge the traditional approach to investment research. Rather than relying on market speculation or the latest stock tips, Shmilov’s goal was to help investors focus on the long-term sustainability of businesses, guided by sound economic principles and AI-powered insights.

Shmilov’s experience as a VP of Product, where he led large-scale platforms used by millions, played a pivotal role in his vision for EcoMoat. His mission was clear: leverage AI to provide professional-quality research that could be accessible to all investors, from individual retail traders to professional portfolio managers.

The Power of Economic Moats

One of the most critical factors in successful investing is understanding a company’s economic moat, its ability to maintain a competitive advantage over time. Popularized by Warren Buffett, the concept of economic moats is seen as a key indicator of a business’s potential to generate sustainable profits. However, many investors still rely on broad stock tips and market speculation rather than a deep, analytical look at these moats.

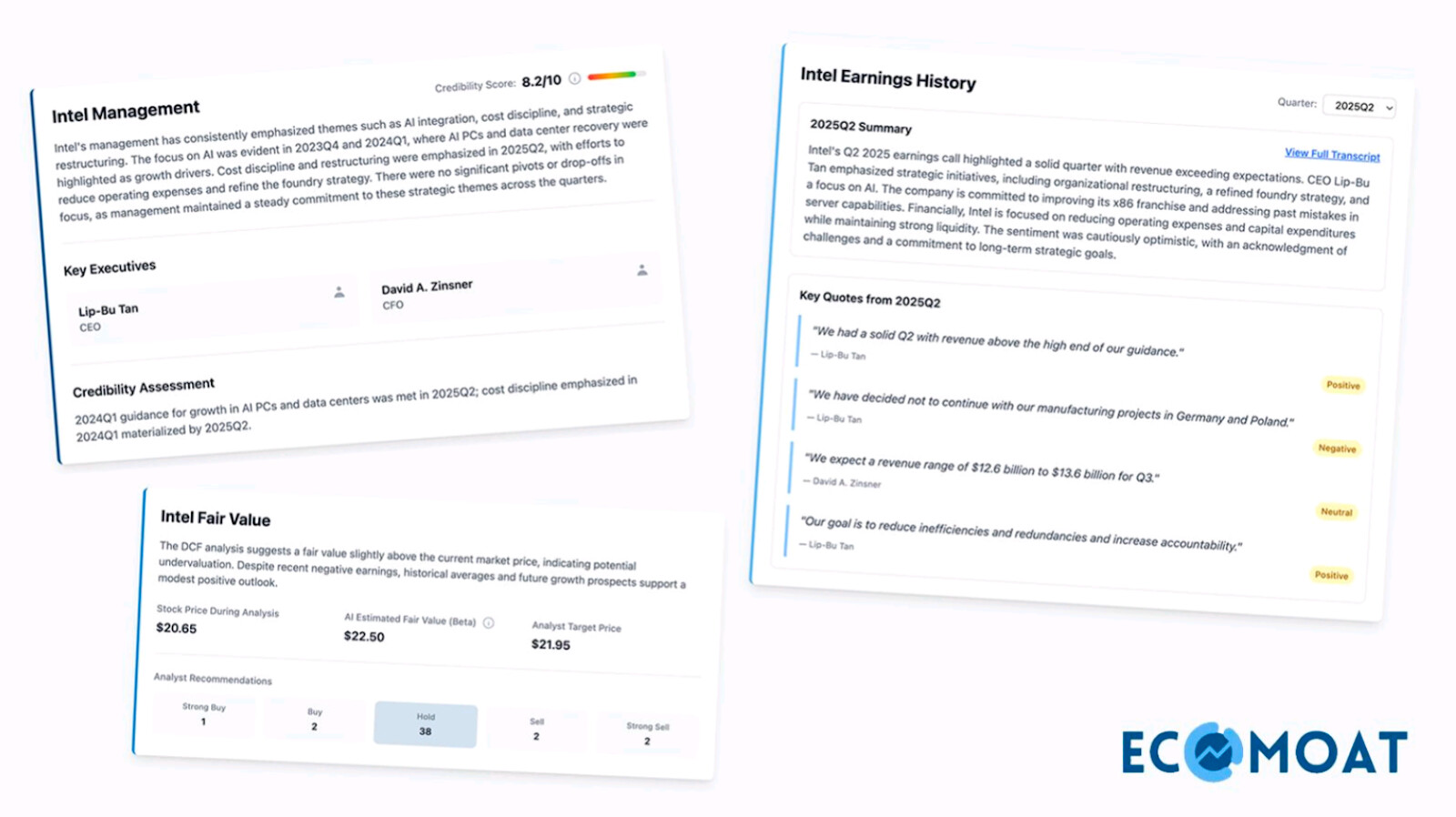

EcoMoat’s core mission is to address this gap by using AI to assess various moat dimensions, including brand, cost leadership, network effects, and switching costs. These factors give investors a clearer view of a company’s long-term viability in the market, moving beyond trends and stock recommendations.

According to Shmilov, “Investors don’t just need stock tips; they need to understand the durability of a business.”

AI and Trust in Investment Research

While AI has the potential to revolutionize investing, its use must be grounded in financial fundamentals to avoid misleading conclusions. EcoMoat’s approach stands out by integrating clean data, financial ratios, earnings call transcripts, and sentiment analysis before the AI model processes the data. This foundation ensures that the platform’s insights are not based on shortcuts, but rooted in thorough analysis.

Shmilov explains, “Most AI tools jump straight to conclusions. EcoMoat starts with fundamentals and clean data, then lets AI explain and surface insights. That’s how we avoid shortcuts and keep research trustworthy.”

This methodology emphasizes the importance of combining advanced technology with careful, data-driven analysis, ensuring that investors receive valuable and reliable insights.

Democratizing Access to Research

One of the significant challenges in the investment research space is the cost of access. Many traditional financial research firms charge thousands of dollars annually for premium insights. EcoMoat aims to make high-quality research accessible to a broader audience. By offering its platform for free, EcoMoat removes the financial barrier that typically limits access to professional-grade tools.

“Research shouldn’t sit behind a $2,000 paywall,” says Shmilov. “EcoMoat makes moat and fair-value analysis available to everyone, so more people can invest with clarity, not guesswork.”

This commitment to accessibility is a key differentiator, but it also raises questions about how free platforms like EcoMoat can continue to sustain their operations without traditional revenue models. The platform’s long-term success will depend on how well it balances accessibility with profitability.

Human + AI, Not Human vs. AI

Despite the promising capabilities of AI, Shmilov emphasizes that EcoMoat’s platform is designed to complement, not replace, human judgment. The AI’s role is to provide fresh insights that investors can use to test their assumptions, strengthening their research rather than making decisions for them.

“EcoMoat isn’t about telling you what to buy, it’s about giving you fresh, unbiased signals to strengthen your own research,” Shmilov says. “The best investors combine human judgment with tools that challenge their assumptions.”

This human-AI synergy is central to EcoMoat’s mission, helping investors develop a deeper understanding of companies and their competitive advantages while encouraging critical thinking and independent decision-making.

A Personal Journey of Innovation

Shmilov’s passion for EcoMoat stems from his personal journey as a product leader. Having built platforms that served millions of users, he wanted to prove that an individual could still make a significant impact by creating a scalable, valuable tool in today’s tech landscape.

“With EcoMoat, I wanted to show that one person can design and build something of real value independently,” he says. His vision has resulted in a platform that challenges the status quo of traditional investment research firms and offers an innovative alternative for investors.

The Future of Investment Research

EcoMoat’s commitment to continuous improvement is evident in the platform’s ongoing updates and refinements. The team is focused on improving AI models, enhancing transparency, and providing sharper insights to meet the evolving needs of investors.

“We want EcoMoat to be a tool that helps people focus on the sustainable strength of businesses, rather than short-term fluctuations,” says Shmilov. As the investment world continues to evolve, EcoMoat’s blend of AI-driven analysis and fundamental research is poised to play a significant role in helping investors make informed, long-term decisions.

Ready to Unlock the Power of Moats?

Are you ready to take your investing to the next level? Explore EcoMoat today and access the AI-powered research that can help you identify companies with sustainable competitive advantages. Whether you’re an individual investor or a professional portfolio manager, EcoMoat’s fresh, unbiased insights will give you the tools you need to make informed, long-term decisions.

Visit EcoMoat.ai to learn more about how you can use AI to enhance your investment strategy.

Connect with EcoMoat: